Sunday

- 8:00 a.m.: I receive an email from my church saying my $25 weekly donation went through.

- 10:30 a.m.: Husband gases up the car at Costco. (-$32.24)

- 11:00 a.m.: I was being extra grouchy, so my husband and I headed to our favorite coffee shop (-$6). We got some (expensive) snacks because we were so hungry and we weren’t meeting our family for lunch until later in the afternoon (-$27.59). The husband got a cream puff for dessert (-$5).

- 2:00 p.m.: Seafood lunch with my sister, her husband, and my parents, -$21.

- 6:00 p.m.: Husband’s grandmother’s birthday. Dinner at his parents’. Hooray for not having to eat out. ($0)

- 8:00 p.m.: Registered our puppy with our county office. Who knew this was even a thing?! (-$41.95)

Total spent: $158.78

Monday

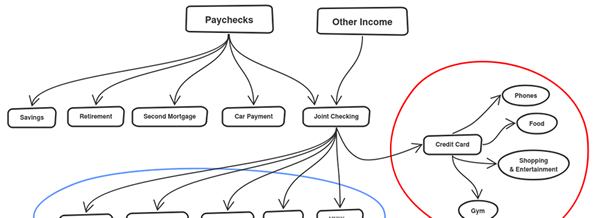

- 8:00 a.m.: Get an email from my bank about some direct deposits:

- My sister paid us back for a previous loan (+$2500). Woohoo!

- But also, it’s the first of the month so mortgage gets auto-deducted (-$2,941.33). Boo.

- Cash rewards from my credit card get auto-deposited (+$58.42).

- 10:00 a.m.: Take the train to work. $3.90 one way doesn’t seem all that cheap to me. (-$7.80 roundtrip)

- 12:00 p.m.: Cough drops and chocolate at Walgreens (-$4.20) I also log in online and pay $2000 towards our credit card. Feels good and bad at the same time.

- 2:00 p.m.: Teammate sends me $14 via Venmo as a refund for our basketball league fee. (+$14)

- 9:00 p.m.: Dinner at Chick fil A after my basketball game (-$15.42)

Total Spent: $2968.75

Total Earned: $2572.42

Tuesday

- 10:00 a.m.: The usual train ride to work. (-$7.80 roundtrip)

- 11:00 a.m.: Husband buys two large packages of water bottles from Costco (probably some snacks from the food court too and didn’t tell me) (-$35.96)

- 12:00 p.m.: Husband’s lunch and my lunch, $16.98.

Total Spent: $60.74

Wednesday

- 9:30 a.m.: Train fare (-$7.80 roundtrip)

- 12:00 p.m.: Eat my leftover Chick fil A from Monday and avoid eating food court food for once. ($0)

- 6:00 p.m.: Snacks from Walgreens to hold us over until our late dinner (-$11.45)

- 9:00 p.m.: My sister and I treat our parents to the House of Prime Rib for their 44th wedding anniversary (-$128.75)

- 10:00 p.m.: Score — I find free tickets online for my dad to watch the AT&T golf tournament in Pebble Beach. I just pay a $1 verification fee.

Total Spent: $149

Thursday

- 7:00 a.m.: Husband gets us coffee (-$3.15). He also deposits $100 cash into our checking account. I forgot about our homeowner’s association dues (-$105) and Best Buy credit card payment that get auto-deducted (-$300). I probably shouldn’t have put so much from our checking towards paying down our credit card debt.

- 8:15 a.m.: Take train in to make a 9 a.m. meeting. (-$7.80 roundtrip)

- 9:00 a.m.: See credit card charges for husband’s Crossfit membership (-$149) and my tuition for online classes I take as part of my veteran’s benefits (my dad was in the Navy) (-$54). Get refund for some pet car mats we returned to Amazon since they didn’t fit our car well (+$43.56).

- 1:00 p.m.: Friend pays us back for a plane ticket we paid for last year (+$69.53)

- 2:00 p.m.: Grab a slice of pepperoni pizza and a pack of rice crackers all from the fancy grocery store near my office (-$8.76)

Total Spent: $627.71

Total Earned: $113.09

Friday

- 8:00 a.m.: Email from my bank: Government paid out my schooling benefits for the past two months (+$1,837.80). Woot! I remind myself not to put too much towards our credit card.

- 10:00 a.m.: Train fare: -$7.80.

- 12:00 p.m.: Lunch from the food court (-$8.05)

- 3:00 p.m.: Was really craving a cupcake because I was in a mood so I bought three — one to eat at the office and two for the husband and I to share later (-$11.44)

Total Spent: $27.29

Total Earned:$1,837.80

Saturday

- 10:30 a.m.: Husbands grabs breakfast for us (-$24.55) and gases car up again (-$36.33).

- 6:00 p.m.: Ordered Chinese food. It was really really not good. (-$45.41)

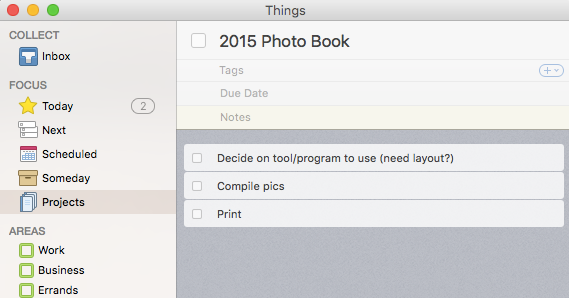

- 9:00 p.m.: I start shopping online for appliances for our kitchen that’s being renovated. I put a new gas range, dishwasher, and microwave in my Best Buy cart. Ebates has 2% cash back and we get 18 months 0% financing with my Best Buy card. I send my husband a screenshot of the breakdown to get his go-ahead before I pull the trigger. We hold off because he wants to see them in person. Save $2700 for now.

Total Spent: $106.29

Observations

WE SPEND SO MUCH ON FOOD. It’s probably not a great excuse, but we are renovating our kitchen, so eating out is really the only convenient option right now.

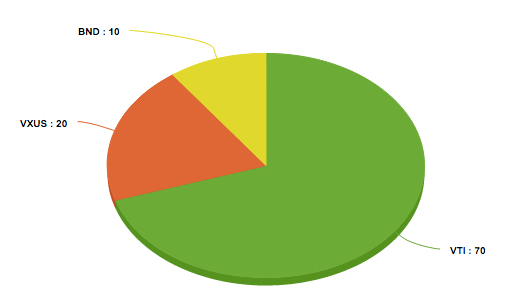

We didn’t buy as many things as we usually do. We had a bunch of expenses last year with the new house, our wedding, and Christmas, so we’ve really been trying to save money since January. We owe quite a bit on our credit card. We typically pay off our card in full before the due date, so carrying a balance has been pretty stressful. We owe a lot in taxes this year too. Documenting everything we spend on has definitely been eye-opening.

Total spent on food: $410.04

Total spent overall: $4098.56

Total income: $4523.31

No Comments