Sunday, July 28

Husband wanted to go out to brunch and threw out some pricier options (all places we would normally go to without giving it a second thought). I declined. We ended up staying in (don’t think the husband was too happy about it). I picked up groceries and we cooked breakfast instead. We stayed home the rest of the day.

Something I’ve been continuously eyeing are some Schleich brand animal figures for my daughter.

These things are a tad pricey ($20 a set) mostly because they are really good quality and very realistic-looking. I don’t know why I’m so fixated on wanting some from her. I feel like a lot of this stems from me not having a whole lot of toys as a child and wanting to give her everything I didn’t have (cue the violins!), but I should realize that I turned out fine (for the most part) without having tons of toys.

Monday to Wednesday, July 29 to July 31

Home stretch!

I forgot I had a massage scheduled on Monday. My company subsidizes the cost, so fortunately it was “only” $40.

It’s been warming up lately and I’m so uncomfortable being so pregnant, so I went online to start looking for some comfy maternity shorts ($14). I even went so far as adding it to my cart and looking for coupon codes, but I told myself that I could wear my husband’s shorts instead.

This week we didn’t have any meal kit deliveries because I didn’t see anything from both Home Chef and Freshly that I liked. Monday I cooked (only spent $10 for a rack of ribs!), but Tuesday and Wednesday we picked up food (about $60 total).

As it’s getting nearer to August, I’m feeling myself starting to online shop a tiny bit more. I am really hoping to continue with my minimal spending, so I’ll have to just constantly remind myself of my goals whenever I’m tempted to make an impulse purchase.

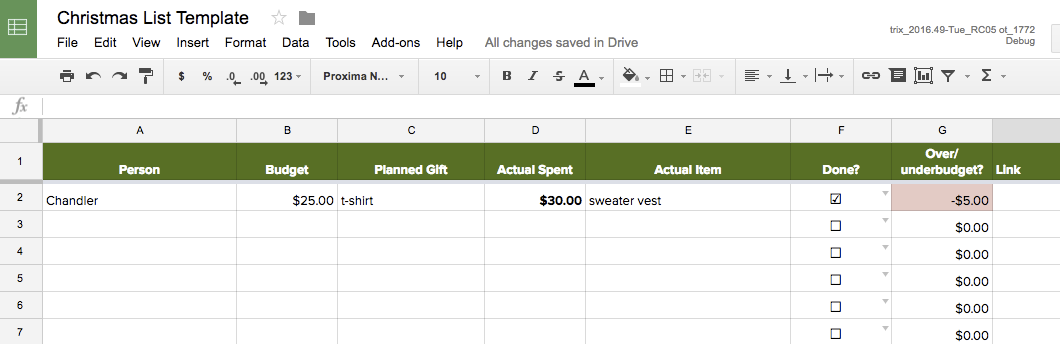

Wanted to Buy But Didn’t

- Animal figures: $20

- Maternity shorts: $14

Total saved: $34

Spent

- Dinners out: $60

Total spent on “unqualified” purchases: $60

Challenge Conclusion

It’s now August 1st and I’m somewhat relieved the challenge is over, but all in all it wasn’t that bad. I think I’ve really gotten used to this new way of thinking–that you don’t need everything you think you do.

I’ve also learned that a lot of our spending comes from eating out/picking up food. This is definitely an area where we struggle. Meal kits help, but I’m sure if I stepped it up even more and planned home-cooked meals we could save hundreds more.

Another thing I realized is that a lot of the things I wanted to buy but held back on were things for my daughter. It’s easy for me to fall into the trap of wanting to get the “best” (things) for her, but in reality, she could care less! She’ll love new toys for a day or so (she didn’t even notice that Owlette PJ Masks doll was missing when I took it away to give it a quick wash), but really she just wants to spend time and play with me more than anything.

With my spending ban now lifted, I did make an offer on that cardigan I had been eyeing from Week 3. I haven’t heard back yet from the seller, but I do feel okay with that (potential) purchase. I waited long enough to make sure it wasn’t an impulse buy and it’s also something that I know I will wear a lot. This whole No Spend Challenge has just made me so much more conscious of my purchases and I’m pretty amazed at how just a month could change my overall perspective.

July just so happened to be a great month for me to do this challenge because we ended up getting a couple of windfalls this month (two bonuses at work and a large really random windfall for my husband) as well. With the money I saved from not spending as much as I normally do coupled with the unexpected income we got this month, we were able to pay down a significant portion of our debt. We literally will be out of debt (aside from our cars) likely by the end of August. Those windfalls we received this month definitely wouldn’t have felt as nice if they had to be thrown at new debt we had incurred. It’s almost like by doing this challenge I “attracted” these opportunities for earning more money. *shrug*

I’m shocked and excited about potentially being able to save and invest again. This challenge has sort of “re-energized” me about personal finance as a whole and I’ve already read three books on the topic. I HIGHLY RECOMMEND reading The Simple Path to Wealth. It’s potentially one of my new favorite books on personal finance.

Overall amount saved: $528+

Total spend on “unqualified” purchases: $628.19

I definitely still spent a lot and didn’t do a perfect job of not spending this month (most of it was spent on non-grocery food), but just compared to what I would typically spend in a month, I’m still pretty proud of what I achieved. It felt great being able to continuously pay down debt as opposed to the debt being a moving target. I’m more happy though about how the challenge has changed my overall outlook on spending.

No Comments