I’m not an expert investor by any means, but I know enough to be able to build an incredibly simple but effective investment portfolio. My approach to investing is keeping things extremely minimal. I generally follow the Bogleheads approach to investing, which was pioneered by the retired CEO of Vanguard, John Bogle.

We have just three exchange-traded funds that make up our investment portfolio: 1) a domestic stock fund, 2) an international stock fund, and 3) a bond fund.

Exchange-traded funds (ETFs) are essentially like mutual funds in that they comprise of a whole basket of assets, but they can be bought and sold more easily like regular stocks. ETFs can be bought for less than $50, while mutual funds usually require a minimum investment of around $1500 or so.

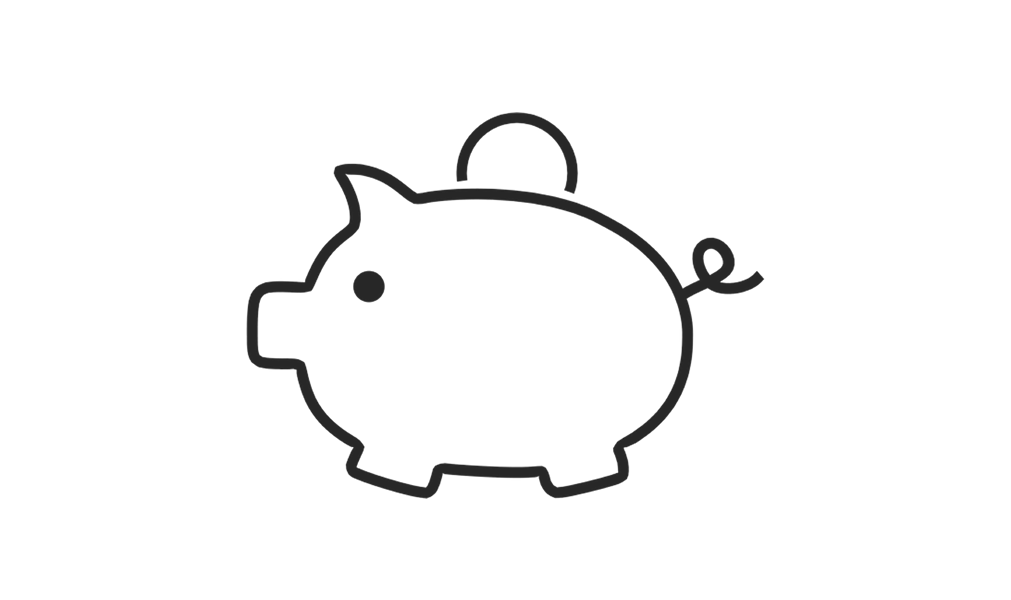

Recently, I had to create a portfolio of funds for my husband’s retirement account. He quit his job back in June of last year to help run a family business, so we rolled over his IRA from his company’s brokerage firm to our own. Here’s what I did to take care of this process:

- Create new Rollover IRA account at Merrill Edge

- Submit withdrawal form to husband’s current brokerage account and provide them with his new account

- Wait for funds to appear in new Rollover IRA account

- Buy shares of each of the three ETFs I wanted until there was no cash left in husband’s account

What was important about buying the shares was making sure I was allocating the right amount to each fund.

VTI: Vanguard Total Stock Market

VXUS: Vanguard Total International Stock Market

BND: Vanguard Total Bond Market

I read that a good rule of thumb is to buy “roughly your age in bonds.” I only allocate about 10% instead of the 20+% I should be, just because we’re willing to take a little more risk.

Overall, I’ve been pretty happy with my decision to have just a three-fund portfolio. Because it’s nice and simple, I’m much more inclined to continue investing.

Suggested resource: The Bogleheads’ Guide to Investing

No Comments