This month I’ve decided to try doing a “no spend month” challenge. I’ve always heard of people doing it and I always thought it was crazy and that I would never be able to do one myself. Our debt, after mostly being paid off around March of this year, has slowly climbed back up, so I wanted to take a month and see if maybe having a no spend month would be helpful. I think it could save us a lot of money just given how much I spend on silly purchases. Second, I’m curious how this challenge might change my mindset about consumerism and just my overall spending.

Rule: Only spend on groceries, bills, gas, and emergencies for the entire month of July

Definitely did a lot of damage “in preparation” for No Spend Month. It was my husband’s birthday on Sunday, June 30th and we spent a ton celebrating. We did an escape room, he got a massage at a nice spa, and we had a way too fancy steak dinner. It was all very bad for our bank account, but I suppose it was the last hurrah before I started this challenge. Kinda feels like when you eat a ton of junk food the night before you start a diet. No? Is that just me?

Monday, July 1

- My mid-year employer stock sales go through and I immediately use about 70% of the proceeds to pay off debt. So sad to have already spent that money even before it hit our account. Was a good reminder why I’m embarking on this challenge.

- This morning my daughter pulls out my set of nice permanent markers that I use for scrapbooking and I cringe–my immediate thought is to get her her own set of washable Crayola markers. If I wasn’t doing this challenge, I would’ve went straight to Amazon to start looking for some. Instead, I add the item to my “Wanted to Buy But Didn’t List”.

- My favorite escape room company just opened their new location and even sent a $15 off coupon via email, but of course I can’t make reservations because of this stupid challenge (that’s what I say in my head, but I know this is a good thing). Was already thinking of ways to circumvent the rules of my own challenge (I could ask my husband to make the reservations since he technically is not doing this with me, but I won’t). I guess this will have to wait until August.

- Spent around $86 on groceries. Felt really good to actually be looking at prices of items and checking for coupons. This whole challenge is just making me really conscious of what I’m purchasing.

While at the grocery store there were some non-food items I was tempted to purchase but didn’t, like a sandwich cutter (to cut the crusts off bread) and markers for Mila.

Tuesday, July 2

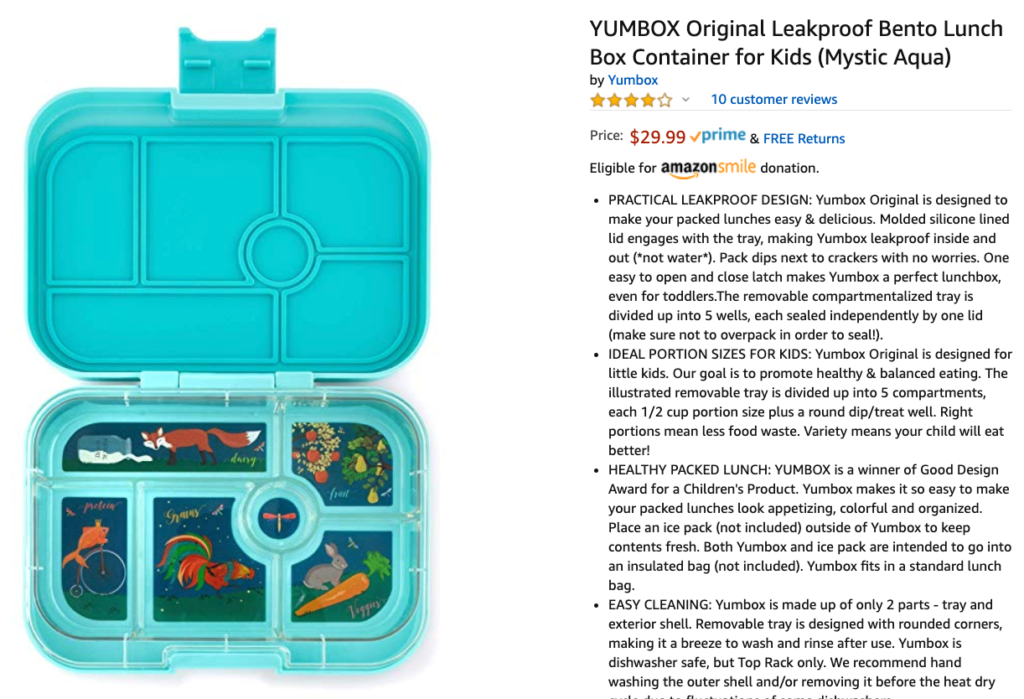

I sent my husband a link to a little lunchbox thing we need to buy for when our daughter goes to preschool on Monday! I didn’t buy it myself since he used his Amazon account to order, but that probably qualifies as cheating… I’ll go ahead and add it to my list of things purchased during this no spend month. 🙁 I had planned on buying this prior to my no spend month, but it only recently was back in stock.

Wednesday, July 3

Did good for most of the day, though we did go pick up Shake Shack for lunch. I was so close to saying no too. Husband “paid,” but let’s face it, this was a fail. It was so hard to pass up Shake Shack! 🙁 Adding to list of purchases.

Tomorrow is the start of the Fourth of July weekend and I know it’s gonna be tough to not spend! We want to watch Toy Story 4 and I’m trying to think how to do this. I do have some movie passes I have yet to use, so that should work!

Thursday, July 4

Wow, didn’t end up spending a ton surprisingly. We ate all meals at home. We did go to the zoo, where we have annual membership to, so we only spent $13 on parking. We actually could’ve even avoided that, but I panicked in the moment and told my husband to just go ahead and park in the paid lot. We also spent $14 on tickets to ride the train–another avoidable cost. My husband did also buy a $6 pretzel, but I declined buying any food for myself. This whole no spend thing is weird when it’s just me doing the challenge and not the whole family.

Friday, July 5

Today I finally finished up the Google photo book for 2018 that I’ve been working on for forever and now it’s time to order and have it printed. It’s going to cost $40. I am making the decision to wait to purchase it until August, which seems silly because I’m not really saving if I’m just putting off the purchase until later, but I’m also not in a huge rush to have the printed book and I’d rather have one less thing to have to add to my list of purchases for the month.

Surprisingly we only spent about $10 today. My husband and I shared a milk tea drink for $5. Normally I wouldn’t even offer to share my drink with him, but I felt like this was a compromise since I was already breaking my no spend rule. My husband later bought one of those small blind bag toys for our daughter and that was a little over $5. I say “he” bought it because it was his idea, though I didn’t technically say no either. Those are the little costs that tend to add up and I want to be better about pushing back on things like that.

Saturday, July 6

Today we visited my sister and her family who live about twenty minutes away from us. We picked up food and had ice cream after ($51.28 total). Food is probably our biggest variable (not fixed like our mortgage and other bills) expense. We’re definitely already doing better this month than most others though, even if it may not seem like it.

Wanted to Buy But Didn’t

- Washable Crayola markers: $6

- Escape room reservations (will book in August even if it means not being able to use the $15 off coupon): $65

- Sandwich crust cutter thing: $20

- Google photo book (will buy in August): $40

Total saved: $131

Spent

- Lunchbox: $30

- Lunch at Shake Shack: $34

- Zoo: $27

- Milk tea and blind bag toy: $10.56

Total spent on “unqualified” purchases: $101.56

No Comments